License and Regulation

Financial Business regulations in Japan are managed by the Financial Services Agency and the Local Finance Bureau, a subordinate organization of the Financial Services Agency. There are laws that regulate each type of business, and each type of business is required relevant licenses to carry out the business. The following is an overview of Japanese financial regulations.

Licenses based on Financial Instruments and Exchange Act

The Financial Instruments Exchange Business Act is a law that regulates investment services. It regulates investment fields such as securities, funds, disclosures, and exchanges.

Financial Instruments Business

There are 4 types of Financial Instruments Business:

(1) Type I Financial Instruments Business

(2) Type II Financial Instruments Business

(3) Investment Management Business

(4) Investment Advisory and Agency Business

The difference in type is the business that carries out, and there is no upper or lower level between each type. In addition, there is financial instruments the Intermediary Service, which specializes in brokerage service belongs to the Type I Financial Instruments Business and Investment Management Business as an auxiliary business.

Besides, there are special services such as “the Specially Permitted Businesses for Qualified Institutional Investors, etc.” which carry out the Self-offering Business, and the Investment Management Business (which originally corresponds to the Type II Financial Instruments Business) limited for the small-sized professional fund with notification only (without registration as a Financial Instruments Business).

There are other services as below:

- “Investment Management Business for qualified institutional investors (Professional Investors)” can receive relaxation of registration requirements if the asset is small (JPY 20 billion).

- “Type I Small-amount Electronic Public Offering Service” that receives an application only for acquiring a small amount of securities online.

- “Type II Small-amount Electronic Public Offering Service” that that receives an application only for acquiring a small amount of securities online.

- “Financial services brokerage service” is an arranger of financial services without affiliated operators.

In general, there are no restrictions on foreign capital in the registration requirements of Financial Instruments Business Operators. Foreign companies can register, and a wholly-owned subsidiary of an overseas financial company can carry out the business In addition, foreigners and non-residents can serve as a board of directors.

The Japanese government is currently offering business-friendly policies by relaxing financial regulations to attract Overseas Financial Companies to come to Japan, mainly in the Asset Management Business.

(1) Type I Financial Instruments Business

The Type I Financial Instruments Business consists of

Securities business dealing with securities (stocks and corporate bonds / STO),

Derivative trading business (FX / securities CFD business),

Receiving cash and securities deposits from customers (securities management business).

In addition, underwriting businesses and licensed PTS are classified as the Type I Financial Instruments Business.

| Capital Requirements | Net assets of JPY 50 million or more |

| Actual necessary Capital | At least about JPY 150 million considering the actual expenses |

| Registration Requirements | Establishment of a board of directors, proper company organization, etc. |

| Necessary total expenses | It is required to expect about JPY 50 million, including compensation and labor costs, before starting the business. |

| Registration Period | 6 months to 1 year |

* If you want to handle (proxy sales) specific unlisted securities ONLINE with the Type I Financial Instruments Business and the Type II Financial Instruments Business, you are required to register as the Electronic Public Offering Service.

Introduction: Among the investment trust sales and securities-related businesses, relatively easy for Institutional Investors. New licenses for FX/CFD are not accessible.

(2) Type II Financial Instruments Business

The Type II Financial Instruments Business is a license mainly for selling securities with low liquidity.

The “Type II Financial Instruments Business” sells low liquidity securities such as the interest of collective investment scheme and trust beneficiary rights other than primary securities such as stocks and corporate bonds. The sale of partnership-type funds is classified as “Type II Financial Instruments Business.”

However, it is required

Real estate-specific joint ventures license for real estate funds and

Product investment advisory business license is required for commodity funds for investment activities. It means that other licenses are necessary for real estate and commodity funds in addition to the registration of the Financial Instruments Business.

The self-offering of certain securities such as investment trust beneficiary certificates and currency-related derivative transactions belongs to the Type II Financial Instruments Business. However, most of the registered the “Type II Financial Instruments Business” is engaged in selling funds and real estate trust beneficiary rights.

| Capital Requirements | Capital of JPY10 million or more |

| The actual required fund | At least JPY 30 million considering various expenses for Funds. It is possible with JPY 10 million if real estate trust beneficiary right. |

| Registration Requirements | Proper company organization, etc. |

| Necessary total expenses | In the case of a fund, it starts from about JPY 30 million, including personnel expenses by starting the business. However, the cost is lower for the real estate trust beneficiary rights business. |

| Registration Period | 6 months to 1 year |

* If you want to handle (proxy sales) specific unlisted securities ONLINE with the Type I Financial Instruments Business and the Type II Financial Instruments Business, you are required to register as the Electronic Public Offering Service.

Furthermore, accepting applications for acquiring such securities online corresponds to the Electronic-application-style Electronic Public Offering Service. In such a case, it is required to register as an Electronic-application-style Electronic Public Offering Services in addition to the Type I Financial Instruments Business or the Type II Financial Instruments Business.

However, it is possible to handle a specific small-amount offering business (only) without registering the Type I Financial Instruments Business or the Type II Financial Instruments Business as a particular case, with the registration of the Type I Small-amount Electronic Public Offering Service and the Type II Small-amount Electronic Public Offering Service.

(3) Investment Management Business

The Investment Management Business manages the property by securities or derivative transactions that consist of Discretionary Investment Business, Fund Management Business, Investment Trust Management Business, and Investment Company Asset Management Business. Investment Trust Management, Discretionary Investment Contracts, and REIT Management are typical businesses.

This business specializes in asset management. It is required to register the Type II Financial Instruments Business to sell collective investment schemes (offering or private placement and offering or handling) or offering or private placement of investment trust beneficiary securities.

It is necessary to register the Type I Financial Instruments Business to sell investment trust beneficiary securities managed by oneself based on a discretionary investment contract as the business corresponds to offering and private placement. The Investment Management Business Operators who manage investment trusts work with securities companies in charge of sales most of the case.

| Capital requirements | Capital / net assets of JPY 50 million or more |

| The actual required capital | At least JPY 100 million considering various expenses |

| Required total expenses | Establishment of a board of directors, proper company organization, etc. |

| Necessary total expenses | At least JPY 40 million, including personnel expenses before starting the business. |

| Registration Period | 6 months to 1 year |

* As a unique business among the Investment Management Business, the “Investment Management Business for Qualified Investors.” Qualified Investors are one of the professional investors stipulated in the Financial Instruments and Exchange Act.

The “Investment Management Business for Qualified Investors.” is officially registered business. Therefore, it can carry out fund business and investment trust consignment business and discretionary investment business, unlike the “Specially Permitted Businesses for Qualified Institutional Investors, etc..” The maximum limit amount of the assets is JPY 20 billion; this includes the assets under the “Specially Permitted Businesses for Qualified Institutional Investors, etc..”

Please also refer to Guidebook for Registration (https://www.fsa.go.jp/en/policy/marketentry/guidebook.html)

(4) Investment Advisory and Agency Business

The Investment Advisory and Agency Business consists of investment advisory business and agency or intermediary business. It is a business that advises on stocks and bonds trading, including Asset Management advice for wealthy people and the advice by robo-advisor or EA.

The service related to agency or mediation is “agent or mediation for the conclusion of an Investment Advisory Contract or Discretionary Investment Contract.” It classified as an intermediary for the investment advisory contracts with existing investment advisors and agents and the conclusion of discretionary investment contracts. Compared to Investment advisory Services, it seems that intermediary service provider is at most 10 to 20% among investment advisory and agents.

It is necessary to register the Type I Financial Instruments Business to sell investment trust beneficiary securities managed by oneself based on a discretionary investment contract as the business corresponds to offering and private placement. The Investment Management Business Operators who manage investment trusts work with securities companies in charge of sales most of the case.

| Capital requirements | Deposit JPY 5 |

| The actual required fund | At least JPY 10 million considering various expenses. |

| Registration Requirements | Proper company organization, etc. |

| Necessary total expenses | Min. JPY 5 Million excluding the deposit above. |

| Registration Period | 4 months to 10 months |

Please also refer to Guidebook for Registration (https://www.fsa.go.jp/en/policy/marketentry/guidebook.html)

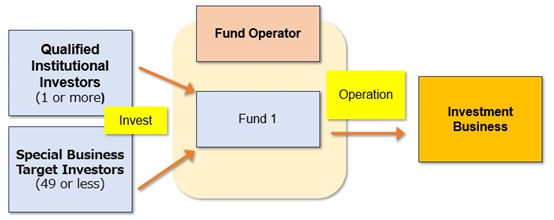

(5) Specially Permitted Businesses for Qualified Institutional Investors

The “Specially Permitted Businesses for Qualified Institutional Investor, etc.” consists of

“Private Offering (Financial Instruments and Exchange Act, Article 2, Paragraph 8, Item 7)” that collects funds from investors to their funds and

“Self-Investment (Financial Instruments and Exchange Act, Article 2, Paragraph 8, Item 15)” that invest the collected money. Overseas funds can use the scheme, and there is no need to set up an office in Japan. However, it is necessary to nominate the representative in Japan. A lawyer is eligible to be the representative.

Those who have notified the “Specially Permitted Businesses for Qualified Institutional Investor, etc.” are called as the Specially Permitted Businesses for Qualified Institutional Investor, etc. Notifier (the Specially Permitted Businesses, etc. Notifier).

The business corresponds to the Financial Instruments Business of Private Offering (No. 7 business) and Self-Investment (No. 15 business). However, it is possible to carry out almost the same business as a Financial Instruments Business Operator as a “Specially Permitted Businesses for Qualified Institutional Investor, etc.” by notification only while satisfying the specific conditions stipulated in Article 63 of the Financial Instruments and Exchange Act.

To establish the “Specially Permitted Businesses for Qualified Institutional Investor, etc.” the funds solicited and managed should consist of “1 or more qualified institutional investors” and “49 or less special business target investors (wealthy, semi-professional, close relationship persons).” Even though there are minor exceptions, in principle, they can carry out Private Offering and Self-Investment as a “Specially Permitted Businesses for Qualified Institutional Investor, etc. Notifier. “

(6) Specially Permitted Business During the Transition Period /Specially Permitted Businesses for Overseas Investors, etc.

From the end of 2021, Fund Management Business (that meets certain requirements) can carry out offering or private placement business for “Overseas Investors” by notification of the “Specially Permitted Businesses for Overseas Investors, etc.” once set up an office in Japan.

The fund invested or contributed to the collective investment scheme of the “Specially Permitted Businesses for Overseas Investors, etc. “is limited to mainly invested or contributed by non-residents and it is required the investment from non-residents should be more than 50% for notification. We expect the investment from residents will be limited to company-related personnel and institutional investors.

In addition to the Specially Permitted Business for Overseas Investors, etc. there is a unique system for the “Specially Permitted Business During Transition Period.” The Specially Permitted Business During Transition Period can carry out within 5 years only from the notification. It is a time-limited measure for 5 years from the law’s enforcement date. The law stipulates the reasons for refusal to register the “Specially Permitted Business During Transition Period” such as those who have not received a license in a foreign country, those who have not passed the period (specified by a Cabinet Order) after receiving the license, and those who do not have a proper organizational structure. The law expects companies with a proven track record to carry out Investment Management in foreign countries.

After submitting a notification of the “Specially Permitted Business During The Transition Period,” the Foreign Investment Manager can carry out Discretionary Investment Business, Investment Trust Consignment Business, Fund Management Business of a foreign collective investment scheme, and other business specified by Cabinet Order at the office established in Japan. Besides, the “Specially Permitted Business During The Transition Period” can carry out the offering or private placement of

beneficiary certificates of foreign investment trusts,

foreign investment securities and foreign collective investment schemes that are managed by themselves at the discretion of investment manager,

foreign investment trust beneficiary securities as a consignor,

foreign collective investment schemes or private placements as an issuer.

However, it is not possible to accept the funds from residents that is a temporary license to set up a base in Japan and explore business development in Japan.

License based on the Payment Service Act

Payment-related services are regulated by the Payment Service Act FINTECH, such as crypto-assets, e-commerce, and remittance services, requires a license under the Payment Service Act in most cases.

Crypto-asset Exchange Service

Crypto-currency exchanges, exchanges, wallet services, ICOs, and other cryptocurrency-related businesses are regulated as the Crypto-asset Exchange Services. However, STO and OTC derivative transactions are the Financial Instruments Businesses, not the Crypto-asset Exchange Service.

Crypto-currency-related businesses can be registered if they are backed by a well-known company or if a leading company has invested and can prepare business funds for JPY 10 billion at least.

| Capital Requirement | JPY 10 Million |

| Required Fund | At least several hundred million |

| Required Expenses | At least JPY several hundred million by starting the business. |

Fund Transfer Business

The fund transfer business is regulated by the Payment Services Act. It is possible to remit up to JPY 3 million with the new system.

| Capital Requirement | Performance deposit required varies depending on the business type |

| Required Fund | Approx. JPY 30 million |

| Required expenses | At least JPY 20 million |

License based on the Real Estate Specified Joint Enterprise Act

Only real estate funds require a real estate-specific joint venture license among the partnership-type funds. It may necessary/not necessary to register the Type II Financial Instruments Business depend on the scheme.

Specific Real Estate Joint Venture License

In principle, it is not allowed to sell the fund to residents backed by sell/buy or rent the real estate regardless of whether in Japan or outside Japan (even if registered as the “Type II Financial Instruments Business”) as the business falls under the category of Specific real estate joint ventures. Therefore, it is necessary to carry out the following procedures regarding specific real estate joint ventures at the Ministry of Land, Infrastructure, Transport, and Tourism.

In order to carry out a specific real estate joint venture business, it is usual to obtain a license as below depends on the business contents.

Type-I business operator (Fund Manager. Appointed as a business execution member/business operator of the fund and manages his fund),

Type-II business operator (Agent/mediator for the conclusion of the contract),

Type-III business operator (real estate management of a special business operator), and

Type-IV business operator (representative/mediator of a special business operator’s contract conclusion).

It is not necessary to obtain a license for a specific real estate joint venture license by entrusting the business to the Type-III business operator and the Type-IV business operator and notifying as a specially permitted company (SPC). Even special permitted businesses can accept investment from general investors, except for a particular size of development-type funds. Another option is to register for a small specific real estate joint venture for small funds. In addition, it is possible to submit a notification as “Specially Permitted Businesses for Qualified Institutional Investors, etc.” to avoid license application as a specific real estate joint venture.

In order to obtain a specific real estate joint venture license, it is necessary to have a good financial foundation, human resources that can carry out the business properly and with an excellent organizational structure, and a business manager assigned to each office. Therefore, to obtain a permit, you need a professional with a real estate asset management career and a large amount of capital.

| Type | Capital Regulations | Regulations | Target Customers | |

| Type-I business operator | Approval | JPY 100 Million | N/A | |

| Type-II business operator | Approval | JPY 10 Million | N/A | |

| Type-III business operator | Approval | JPY 50 Million | Same as SPC | |

| Type-IV business operator | Approval | JPY 10 Million | Same as SPC | |

| Small -sized specific real estate joint venture | Registration | JPY 10 Million | Total JPY 100Million JPY 1 Million/person or below (SPC JPY 100 Million or below) |

* It is necessary to meet the net asset requirement of 90/100 of Capital is equivalent to by net asset (deducting the total amount of liabilities from the total amount of assets).

| SPC (Specially Permitted Company) | Notification | Outsource transaction to TYPE-III business operator, outsource solicitation to TYPE-IV business operator | Limited to Professional for certain scheme | |

| Specially Permitted Businesses for Qualified | Notification | Limited to super professional |

Money Lending Business License

If you want to carry out a money lending business in Japan, you must register as a money lender. Entry is relatively easy, but the interest rate is low, with a maximum interest rate is limited to 15%/year by law, making it challenging to make a profit.

Money Lending Business

| Capital Requirement | Net assets of JPY 50 million or more |

| Required Fund | Approx. JPY 60 million |

| Expected total expenses | Approx. JPY 5 million, including personnel expenses before starting the business. |

Other Financial Business Licenses

The main Financial Business Licenses managed by the Financial Services Agency of Japan are as follows. It is not easy to enter into banking and insurance sector. On the other hand, it is relatively easy to enter investment services such as Asset Management.

Financial Institutions handling deposits

Banks, Bank holding companies, Credit Unions Banks, Labor Banks, Credit Unions, Affiliated financial institutions, concurrent Trust Financial Institutions, Banks and other financial institutions, Foreign Bank agency banks

Financial Instruments Business Operator

Financial Instruments Business Operator (above), Designated Parent Companies, Registered Financial Institutions, Exchange Trading Licensed Business, Financial Instruments Intermediary Service Provider, Securities Finance Companies, Registered Investment Companies, Specially permitted Business for qualified institutional investors, etc. Credit Rating Companies, Specific Financial Indication Calculator, High-speed Trading Business

Insurance Business

Life Insurance, Non-life insurance, Insurance holding company, Small amount Short-Term Insurer, Licensed Specific Insurer, Insurance Broker

Trust company

Trust company, Self-trust Company, Trust Contract Agency

Financial Company

Moneylenders, Special Financial Company, Prepaid Payment method (third party type) issuers, Prepaid payment method (in-house type) issuers, Fund Transfer Business (above), Special Purpose Companies, Electronic Bond Recording Institutions, Crypto-assets Exchanger (above), Inexhaustible

More Information