What is the SPBQII?

Contents

About Specially Permitted Businesses for Qualified Institutional Investor, etc.-Quick Start-Up Options-

Requisition of Specially Permitted Businesses for Qualified Institutional Investor, etc.-

Qualified Institutional Investor-Restrictions on Investor offering for Specially Permitted Businesses-

Items to be confirmed upon offering investors for Specially Permitted Businesses-Exception for Venture Fund-

Benefits of Specially Permitted Businesses for Qualified Institutional Investors, etc.

About Specially Permitted Businesses for Qualified Institutional Investors, etc.

The Financial Instruments Business is classified into four categories below:

“Type I Financial Instruments Business,”

“Type II Financial Instruments Business,”

“Investment Advisory and Agency Business” and

“Investment Management Business.”

It is necessary to register to carry out each business, and it will cost a lot such as fees for procedures to specialists, membership fees of a self-regulatory organization, registration license tax. Besides, it will take about 6 months to 2 years before starting the business, from the pre-screening to the formal application.

Of course, it costs labor costs to meet organizational requirements, and, of course, it is necessary to pay the labor costs during the examination period. It will not easy to start the business.

Quick Start-Up Options

We understand to start a business quickly from the viewpoint of company management. However, it isn’t easy to start a business in a short time in a month or two under the current Financial Instruments and Exchange Act. There is a way to acquire an already registered company. Still, it is risky, and it usually takes time to proceed with the registration change to start the business after the acquisition.

Considering these issues, if you are planning a fund business mainly for institutional investors, the Specially Permitted Businesses for Qualified Institutional Investors, etc. will be the easiest way to start a business. The Specially Permitted Businesses for Qualified Institutional Investors, etc. is also called Professional Funds for a small-group. The registration period may differ by each regional Finance Bureau, but overseas companies need to notify the Kanto Finance Bureau, and their process is quite prompt.

Overseas companies are not necessary to set up an office in Japan. It needs to appoint a domestic representative or a domestic agent.

“Specially Permitted Businesses for Qualified Institutional Investors, etc.” consists of

“Private Offering (Financial Instruments and Exchange Act, Article 2, Paragraph 8, Item 7)” that collects funds from investors to their funds and

“Self-Investment (Financial Instruments and Exchange Act, Article 2, Paragraph 8, Item 15)” that invest the collected money.

“Specially Permitted Businesses for Qualified Institutional Investors, etc.” can carry out these two businesses legally without registering as “Financial Instruments Business.” Those who have notified “Specially Permitted Businesses for Qualified Institutional Investors, etc.” are called as Specially Permitted Businesses for Qualified Institutional Investors, etc. Notifier (Specially Permitted Businesses Notifier).

The business corresponds to the Financial Instruments Business of Private Offering (No. 7 business) and Self-Investment (No. 15 business). However, it is possible to carry out almost the same business as a Financial Instruments Business Operator as a “Specially Permitted Businesses for Qualified Institutional Investors, etc.” by notification only while satisfying the specific conditions stipulated in Article 63 of the Financial Instruments and Exchange Act. What is “Specially Permitted” is the registration obligations specially exemption cases for the Type II Financial Instruments Business and the Investment Management Business.

Concerning blockchain technology, it has been attracted in recent years that it is possible to carry out a private offering of security tokens of the collective investment scheme type by taking technical measures to restrict certain transfers.

Requisition of Specially Permitted Businesses for Qualified Institutional Investors, etc.

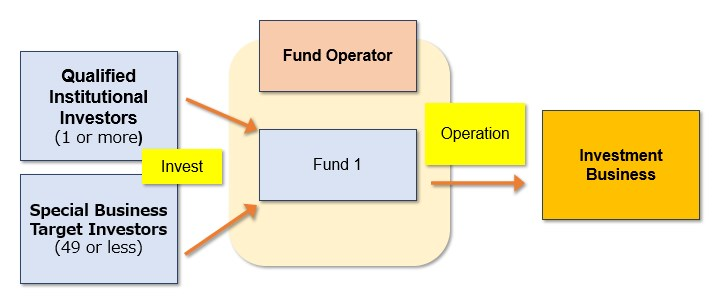

To establish “Specially Permitted Businesses for Qualified Institutional Investors, etc.,” the funds solicited and managed should consist of “1 or more qualified institutional investors” and “49 or less special business target investors (wealthy, semi-professional, close relationship persons).” There are minor exceptions, such as an unqualified investor or a qualified institutional investor is a limited investment partnership. However, in principle, they can carry out Private Offering and Self-Investment as a “Specially Permitted Businesses for Qualified Institutional Investors, etc. Notifier. “

※1 or more qualified institutional investors・・・

Type I Financial Instruments Business Operator (securities company) engaged in securities-related business

Investment Management Business

Investment Limited Partnership (LPS) with net assets of JPY 500 million or more

Individuals or (Notified) corporations with a securities balance of JPY 1 billion or more

* In the case of an individual, one year or more of transaction experience

A foreign financial institution that meets specific requirements and has filed a notification

* Many other types are defined.

※49 or less special business target investors (wealthy, semi-professional, close relationship persons)・・・・・・

National and local governments

Bank of Japan

Financial Instruments Business Operator (other than the Type I Financial Instruments Business Operator and Investment Management Business Operator), particular companies

Persons who have a close relationship with the particular companies (including executives/employees of the special company, parent company, subsidiaries (including subsidiaries of the parent company), investment managers, investment advisors (investment advice to the relevant person), the parent company, subsidiary, of the particular company, the investment manager, the officer or employee of the investment advisor, the particular company and its officer or employee, the parent company, subsidiary, investment manager, relatives of officers or employees of investment advisors (3rd degree))

Listed company

Corporation (net assets or capital of JPY 50 million or more)

Subsidiaries, affiliates of Financial Instruments Exchange Business Company, listed companies, corporations (net assets or capital of JPY 50 million or more)

Special public corporations, Independent administrative corporation

Special purpose company

A pension fund, foreign pension fund (financial investment assets of JPY 10 billion or more)

Foreign corporation

Individuals (investable financial assets (rights related to securities and derivative transactions, etc.) JPY 100 million or more and one year after opening a securities account), corporations (investable financial assets JPY 100 million or more)

Asset Management company

Individuals/corporations who are business execution union members (financial investment assets of JPY 100 million or more) such as unions, anonymous unions, limited liability business unions, or foreign unions

Public interest incorporated associations and public interest incorporated foundations (national and local public organizations hold more than a quarter of the total number of voting rights and contributions, and the business related to regional and industrial promotion for the public interest.

Foreign union funds

Qualified Institutional Investor

The requirements for notification of Specially Permitted Businesses for Qualified Institutional Investors, etc. are “1 or more qualified institutional investors and 49 or less investors for special business”. It is essential to find one or more qualified institutional investors, and the number of investors for special business is limited.

In particular, there is a comprehensive supervisory guideline for the Financial Instruments Business for qualified institutional investors. The comprehensive supervisory guideline X-1-2 Understanding the actual situation (2) stipulates that not to qualified as qualified institutional investors as they receive compensation for the insubstantial work or they are a subsidiary or an affiliated company of the Specially Permitted Businesses for Qualified Institutional Investors, etc. Operator.

And the comprehensive supervisory guideline X-1-2 Understanding the actual situation (3) stipulates that “The Specially Permitted Businesses for Qualified Institutional Investors Operators, etc. or the fund managed by the Specially Permitted Businesses for Qualified Institutional Investors, etc. is an only qualified institutional investor and carry out private offering or fund management while not fulfilling the requirements for Specially Permitted Businesses for Qualified Institutional Investors, etc..

As a result, the scheme will not allow vehicles under the control of subsidiaries, affiliated companies, and funds (managed by the company) to be designated as qualified institutional investors to establish Specially Permitted Businesses for Qualified Institutional Investors, etc..

Even foreign companies and individuals can file a notification and become Qualified Institutional Investors if they hold securities of JPY 1 billion or more. In addition, securities companies and Investment Management Business Operator with foreign licenses can file a notification and become qualified institutional investors if they have a capital of JPY 50 million or more.

Even if there are no qualified institutional investors in Japan, these foreign companies and individuals can be nominated as qualified institutional investors.

Restrictions on Investor offering for Specially Permitted Businesses

Regarding the limit of 49 or less investors for Specially Permitted Businesses, it will be an important issue to form a fund for semi-professional investors such as company owners and wealthy individuals rather than institutional investors, i.e., whether it is possible to raise funds from investors for Specially Permitted Businesses up to the maximum of 49 people each time by establishing the 2nd and 3rd funds. The conclusion will depend on the content of the investment operation.

When investing mainly in securities (more than 50% of assets under management) or derivative transactions, it falls under the self-management business (No. 15) of Specially Permitted Businesses for Qualified Institutional Investors, etc.. In the self-management business of Specially Permitted Businesses for Qualified Institutional Investors, etc., the maximum number of investors is 49 as long as the same investment manager and target even if establishing a new fund.

If it is difficult to judge whether it is considered as the same investment target or not, please contact us as the standards are not specifically specified in the law.

Rules on Totaling the Number of Investors

If the investment target of the new fund is different, or even if the same investment target, it is possible to establish multiple funds for the same investment target (other than securities or derivative investment) practically with more than 49 Qualified Institutional Investors for the Specially Permitted Businesses.

However, suppose the same business to investment is not an investment in securities or derivatives, the provisions of Article 17-4, Paragraph 4, Item 2 (a) of the Order for Enforcement of Financial Instruments and Exchange Act (The 6-month total rule) shall apply. The article stipulates that the total number of investors for funds (Specially Permitted Businesses) with the same investment issued within 6 months must be 49 or less. Thus, the total number of investors for Specially Permitted Businesses is a maximum of 49 in total within 6 months.

Restriction of Transfer

When establishing a fund, it is required to impose the restriction that qualified institutional investors can only transfer fund interests to qualified institutional investors; a Specially Permitted Businesses investor can collectively transfer fund interests to 1 qualified institutional investor or Specially Permitted Businesses investor. In addition, if the interest falls under the security token (if the right appears in property value), it is necessary to secure the transfer restrictions by technical measures (Article 234-2, Paragraph 1, Item 3 of the Cabinet Office Ordinance on Financial Instruments Business).

Limitation of number of Investors per fund

It is often misunderstood that the total number of investors per fund for Specially Permitted Businesses is limited to 49. However, the 49 investors are the limit for Specially Permitted Businesses, and there is no explicit limit on the number of qualified institutional investors. Specially Permitted Businesses for Qualified Institutional Investors, etc. are classified as “private offering services,” It is interpreted to allow the maximum of 499 investors for the same investment target. However, there is no issue as long as the total number of investors in the fund exceeds 49 qualified institutional investors such as securities companies and banks.

Restriction on Funds of Funds

Article 63, Paragraph 1 of the Financial Instruments and Exchange Act states that the following cases do not fulfill the requisitions of Specially Permitted Businesses for Qualified Institutional Investors, etc..

(a) A special purpose company (stipulated in Article 63 Paragraph 3 of the Financial Instruments Exchange Act) that holds Asset-backed securities issued (stipulated in Article 2, Paragraph 11 of the Act on Liquidation of Assets) other than qualified institutional investors.

(b)A Person (company) who sells or wants to sell the rights listed in Article 2, paragraph 2, item 5, or item 6 in an anonymous union contract related to investment business (an anonymous union contract stipulated in Article 535 of the Commercial Code) other than a qualified institutional investor.

(c) A person who invested is equivalent to listed in (a) or (b) above specified by a Cabinet Office Ordinance.

Persons equivalent to those listed in (a) or (b) are specified in Article 235 of the Cabinet Office Ordinance on Financial Instruments Business.

In principle, it does not meet the requirements of Specially Permitted Businesses for Qualified Institutional Investors, etc. if the fund receives investment from an SPC in which non-qualified institutional investors have invested(No. 1) or a collective investment scheme fund non-qualified institutional investors have invested(No. 2).

However, it is allowed as an exception for the following cases,

If the total number of investors (other than qualified institutional investors) of parent and child funds in LPS or LLP is 49 or less (No. 2 (a) (1)), or

If the investment manager manages the funds. (No. 2 a (2) of the same), and the total number of investors (other than qualified institutional investors) of parent and child funds is 49 or less (No. 2 b of the same).

It does not allow to attract a large number of investors (other than qualified institutional investors) indirectly by the two-tiered fund of funds.

Items to be confirmed upon offering investors for Specially Permitted Businesses

A practical issue to carry out Specially Permitted Businesses for Qualified Institutional Investors, etc. is the obligation to check investors’ eligibility for Specially Permitted Businesses, especially for individual clients.

The Supervisory Guidelines (IX-1-1 Solicitation/Explanation System (1) Key Points ) stipulates the requirement of Specially Permitted Businesses for Qualified Institutional Investors, etc..

It shows that it is necessary to confirm and manage the attributes of all investors to carry out Specially Permitted Businesses for Qualified Institutional Investors, etc.. It would be easy to ensure the company is eligible to Specially Permitted Businesses Investors, such as checking a company registration certificate with a capital of JPY 50 million or more.

On the other hand, it is necessary to request the submission of a transaction balance report of a securities company confirming to own the financial investment assets of JPY 100 million or more, except for cases where the name is listed in the securities report. Therefore, it would be certain psychological hurdles.

The definition of investable financial assets is limited to the following assets listed in Article 62, item 2 (a) to (g) of the Cabinet Office Ordinance on Financial Instrument Exchange Business.

Listed in Article 62, item 2 (a) to (g)

(a) Securities (except for listed in (e) and (f) (limited to those listed in the Specially Permitted Businesses special Operator prescribed in Article 2, Paragraph 9 of the Real Estate Specified Joint Enterprise Act (Act No. 77 of 1994).)

(b) Rights related to derivative transactions

(c) – Specified savings prescribed in Article 11-5 of the Agricultural

Cooperatives Act (Act No. 132 of 1947),

– Specified savings prescribed in Article 11-11 of the Fisheries

Cooperative Association Act (Act No. 242 of 1952),

– Specified deposits prescribed in Article 6-5-11 of the Act on

Financial Business by Cooperatives (Act No. 183 of 1945),

– Specified deposits prescribed in Article 89-2 of the Shinkin Bank Act

(Act No. 238 of 1952), etc.

– Specified deposits prescribed in Article 17-2 of the Long-Term Credit

Bank Act (Act No. 187 of 1952),

– Specified deposits prescribed in Article 94-2 of the Labor Bank Act

(Act No. 227 of 1952),

– Specified deposits prescribed in Article 13-4 of the Banking Act,

– Specified deposits prescribed in Article 59-3 of the Agriculture and

Forestry Central Bank Act (Act No. 93 of 2001) and

– Specified deposits prescribed in Article 29 of the Central Bank Act of

Commerce and Industry Association (Act No. 74 of 1997)

(d) – Specified mutual aid contract prescribed in Article 11-27 of the

Agricultural Cooperatives Law,

– Specified mutual aid contract prescribed in Article 12-3,

Paragraph 1 of the Consumer Cooperative Association Act (Act

No. 200 of 1952),

– Specified mutual aid contract prescribed in Article 15-12 of the

Fisheries Cooperative Association Law,

– Specified mutual aid contract prescribed in Article 9-7-5,

Paragraph 2 of the Small and Medium-Sized Enterprises

Cooperative Association Law (Act No. 181 of 1945)

– Rights related to insurance claims, mutual aid claims, refunds and

other benefits based on the specified insurance contract

stipulated in Article 300-2 of the Insurance Business Law

(e) Trust beneficiary rights pertaining to specified trust contracts stipulated in Article 24-2 of the Trust Business Law

(f) Rights based on the real estate specified joint venture contract stipulated in Article 2, Paragraph 3 of the Real Estate Specified Joint Enterprise Law

(g) -Transactions in the Commodity Market (transactions in

the Commodity Market prescribed in Article 2, Paragraph 10 of

the Commodity Derivatives Trading Act (Act No. 239 of 1945)),

– Foreign Commodity Market Transactions (foreign

commodity market transactions prescribed in Article 2, Paragraph 13 of the same Act. The same shall apply in Article 67, Item 1) and

– OTC commodity derivative transactions rights (over-the-counter

commodity derivative transactions prescribed in Article 2,

Paragraph 14 of the same Act. The same shall apply in Article 67,

item 2 and Article 123, paragraphs 9 and 13. )

Limitation on investment by closely related persons and persons with knowledge and experience of the investment

It is noted that it is not allowed to establish a fund if the following persons hold more than 50 % of the interest.

Persons with the close relationship” (Cabinet Office Ordinance on Financial Instruments and Exchange Acts, Article 233-2, Paragraph 1, Item 2 (excluding parent company, etc.)) to Item 6 Persons listed (excluding those who fall under any of the items of Article 17-12, Paragraph 1 (excluding item 6) of the Order for Enforcement on the Financial Instruments and Exchange Act)) and

Persons with the knowledge and experience of the investment.

“Persons who have knowledge and experience regarding the investment” are those who are not classified as Investors for Specially Permitted Business but recognized to have a certain level of knowledge and experience. They can invest in a specific form of venture capital even if they are not classified as Investors for Specially Permitted Businesses. We will explain the particular form of the venture fund in the next section.

The supervisory guidelines stipulated the requirements of the Specially Permitted Businesses for Qualified Institutional Investors, etc. as below. It is also required to confirm whether the person applies to those who have the knowledge and experience in the investment.

The customer to be solicited is a person who has “knowledge and experience in the investment” (a person who falls under any of the items of Article 233-3 of the Cabinet Office Ordinance on the Financial Instrument Exchange Act (Excluding the person who falls under the Article 17-12, Paragraph 1 of the Order for Enforcement on Financial Instrument Exchange Act, which is the same in IX below.) ) If the person falls under “who has carried out the business with professional knowledge indispensable to carry out the business continuously,” it is necessary to confirm the facts by requesting a work history certificate created by the company that belonged to the company at the time of engaging in the business, and create the internal records and store it properly.

Exception for Venture Fund

The Venture funds that meet certain conditions below can invest in the fund as a person who has knowledge and experience in matters related to investment, even if they do not fall under the investors for Specially Permitted Businesses.

Equity investment in unlisted companies is more than 80%,

No borrowing of funds or guarantee of debt, in principle.

No mid-term redemption in principle.

Investment Contract stipulates the matters specified by Cabinet Office Ordinance as below

Name/content of fund, trade name/name, and address of all

investors and managers,

Amount of money invested by individual investors,

Provision of financial statements and audit reports to investors,

hold a general meeting of investors and

Investor’s right to dismiss the manager, right to change the contract

5. Deliver a document stating the above items and explain it to the investors before concluding the investment contract.

It is necessary to submit a contract at the time of notification of Specially Permitted Businesses for Qualified Institutional Investor, etc. or at the time of notification of change. In practice, the relevant Finance Bureau will check the contract whether the above notification requirements are fulfilled or not. Therefore, it is necessary to prepare the investment contract carefully to comply with the relevant laws.

* Who is knowledgeable and experienced in investment?

Officers/former officers of listed companies or corporations (net assets or capital of JPY 50 million or more) and companies submitting Annual Securities Reports

Business executives/former business executives of Investment unions, anonymous investment unions, limited liability business unions, or foreign unions (financial investment assets of JPY 100 million or more)

Engaged the following business activity as a company officer, employee, consultant for a total of 1 year or more, and the period from the date of the last engagement to the date (of becoming the other party of the solicitation) is less than 5 years:

– establish a company,

– increase capital,

– issue stock acquisition rights,

– launch a new business,

– create a business strategy,

– corporate finance,

– investment activity,

– manage a general meeting of shareholders or a board of directors

– the listing of shares.

Persons listed as the top 50 or top 10 shareholders in the securities registration statement or securities report submitted within 5 years from the date of the solicitation

Certified management innovation support organization (lawyer, accountant, etc.)

Companies controlled by the above investors

Benefits of Specially Permitted Businesses for Qualified Institutional Investors, etc.

There are 3 main benefits of a fund establishment and offering by the Specially Permitted Businesses for Qualified Institutional Investors, etc. scheme instead of the Type II Financial Instruments Business registration. We believe it is worth studying if you are exploring establishing a fund for institutional investors, large investors, semi-professionals such as wealthy people.

Able to start business faster

The process to form Specially Permitted Businesses for Qualified Institutional Investors, etc. will be completed relatively quickly. on the other hand, registration of the Type II Financial Instruments Business will take 2 months (standard application period) from the submission and starting of the business. In reality, there will be discussions to fill in the application documents before submitting this application to the relevant Finance Bureau. The preliminary discussion will take almost a year as a preliminary examination becomes stricter year by year.

However, it is possible to start Specially Permitted Businesses for Qualified Institutional Investors, etc. within two weeks at the earliest. While it is necessary to register the Type II Financial Instruments Business, Specially Permitted Businesses for Qualified Institutional Investors, etc. is a notification of no examination in principle under the Administrative Procedure Act. Thus, the business can be started in a short time.

Lower Cost

There is a benefit to utilize Specially Permitted Businesses for Qualified Institutional Investors, etc. In terms of costs. It will take time to register the Type-II Financial Instruments Business takes time. Besides the labor costs during the registration period, the fees paid to specialists are costly, too. On the other hand, Specially Permitted Businesses for Qualified Institutional Investors, etc. is just a notification procedure. Therefore, it is possible to set up at a lower cost than the registration of Type II Financial Instruments Business in most of the case.